reit dividend tax south africa

This in contrast to normal company earnings which are taxed at 28 within the company before 20 dividend withholding tax is applied to dividends paid out to investors. RE ITs may also invest in property in other countries.

Reit Dividends In The Wake Of The Coronavirus

Ad Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives.

. Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation. As a REIT by its nature distributes most of its net income to its investors the REIT itself usually pays little or no income tax. Such person will however be exempt from dividends tax in respect of such dividend.

Effectively the after tax income is determined by the investors tax profile and not by the corporate nature or tax profile of the dividend payer as. A reduced dividend withholding rate in terms of the. In addition to the adverse effect that COVID-19 has had on the South African economy the crisis has.

The Real Estate Investment Trust REIT tax regime in South Africa was addressed for general review in Annexure C. South African REITs own several kindof commercial s such asproperty shopping centres office buildings factories warehouses hotels hospitals and residential property in SouthAfrica. Received by a non-resident from a REIT will be subject to dividend withholding tax at 15 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation DTA between South Africa and the country of residence of the unitholder.

Such person will however be exempt from dividends tax in respect of such dividend. A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued from a REIT at a maximum rate of 40. Ignoring commercial considerations in relation to this fairly common occurrence often the shareholders of the target company in these circumstances would be motivated for income tax reasons to rather sell the shares in the target company to the REIT as opposed to a sale by the target company of each of the immovable properties which may inter alia attract.

Moreover it must be noted that a REIT is not subject to capital gains tax in respect of properties that it disposed of and dividends declared by a REIT to South African shareholders are not exempt but are in fact part of the shareholders taxable income. Last updated in May 2020. Foreign shareholders of SA REITs are levied a dividend withholding post tax at the current rate of 20 but this can be reduced in terms of the rates set by the applicable double tax agreement between South Africa and the domiciled country of the investor.

Instead the shareholder pays income tax on the. INTRODUCTION On 13 May 2016 the South African Revenue Service SARS released a draft interpretation note on the taxation of REITs and controlled companies. This creates an issue that individual investors in REITs are not able to receive the benefit of the reduction in the corporate income tax rate due to the type of company they are invested in.

REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt from income tax in terms of the exclusion to the general dividend exemption contained in paragraph aa of section 101ki of the Income Tax Act because they are dividends. REIT distributions are not considered interest and is effectively distributed as taxable dividend which is exempt REIT distributions from dividend withholding taxes ie. Interest distributions by a REIT or a controlled property company payable to South African resident investors are recharacterised as taxable dividends ie the normal tax exemption for dividends does not apply but dividends withholding taxes will not apply.

Tax consequences for REITs of foreign exchange movements COVID-19 The outbreak of the coronavirus COVID-19 pandemic has affected the global foreign exchange forex market as reflected by the increased volatility in forex. On dividends on REIT investments until they receive their pension payments for the funds. 58 Dividends Tax sections 64E1 64F1.

In this regard one of the requirements that needs. A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued from a REIT at a maximum rate of 40. Real Estate Investment Trust REIT.

Now that you know when a company SHOULD be paying out dividends youll be able to spot if a company is paying out dividends for the wrong reasons. Maintaining the JSE listing as a REIT is therefore imperative. South African resident natural persons.

In other words only South African listed REITs qualify for the REIT tax regime. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets. REIT Dividends - South African tax resident shareholders.

Rental income itself includes qualifying distributions derived from a controlled company. FORTRESS REIT LTD A. REITs are therefore effectively allowed to operate on a tax neutral basis.

A dividend will be deemed a qualifying distribution as long as 75 or more of the gross income of the REIT or controlled company paying the dividend was attributable to rental income in the preceding year of assessment. AnnexureC also referred to the implementation of the Financial Sector Regulation Act No9 of 2017 and the establishment of the Financial Sector Conduct Authority FSCA which provide for the regulation of unlisted REITs as it is proposed that. Dividend paying REIT stocks in South Africa.

Put simply a REIT may deduct for income tax purposes distributions made to its shareholders. South African tax resident investors receives the gross taxable dividend. Be subject to a 20 dividends tax which is in fact a tax on the investor.

Real estate investment trusts REITs are subject to a special tax regime in South Africa. In South Africa a REIT receives special tax considerations and offers investors exposure to real estate through shares listed on the Johannesburg Stock Exchange JSE. Recharacterisation of interest distributions.

One of the four elements to ensure the efficacy of a tax according to Adam Smith is certainty meaning a taxpayer can. Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios.

/dotdash_Final_Why_Structured_Notes_Might_Not_Be_Right_for_You_Nov_2020-01-eae4f9726a074ae1b50bca26e257d429.jpg)

Why Structured Notes Might Not Be Right For You

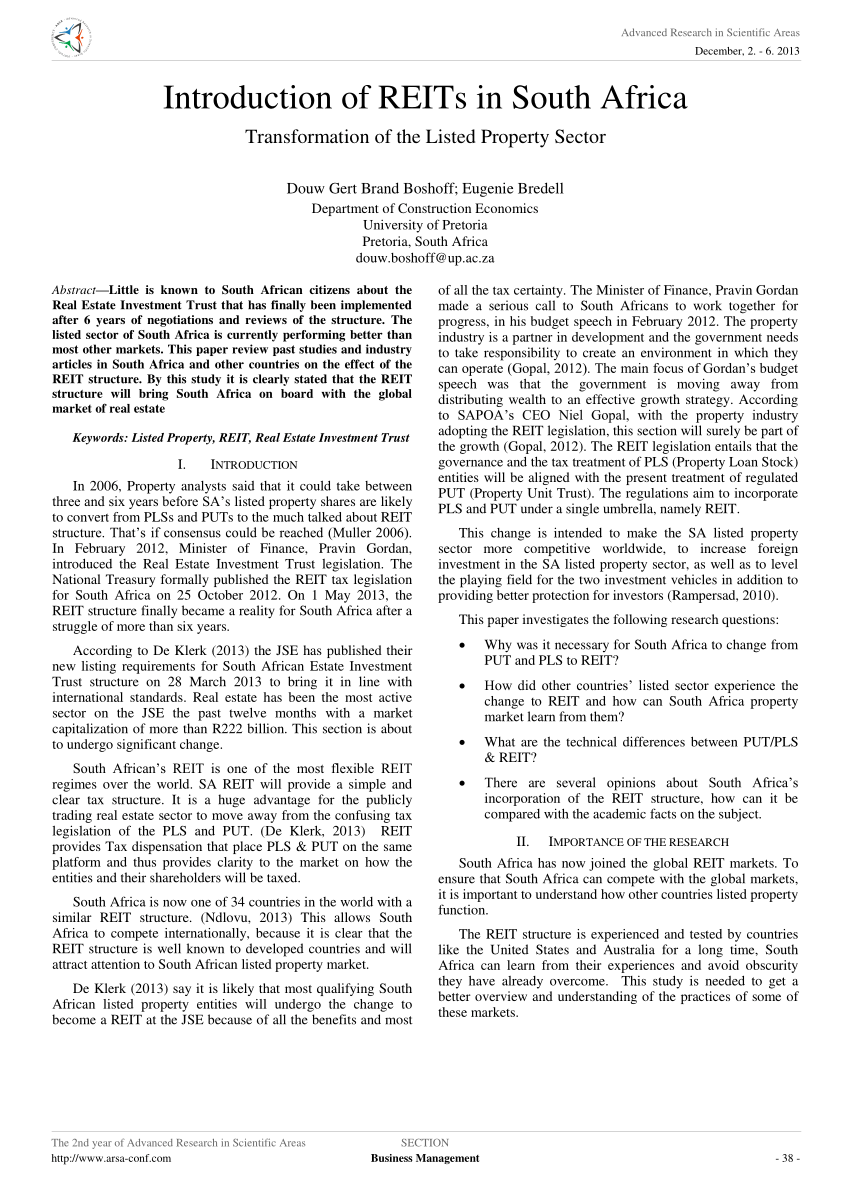

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

South Africa Foreign Dividends And Gains By Reits Kpmg United States

South Africa Reits Investing Offshore International Tax Review

Moat Companies For A Sustainable Future Vaneck

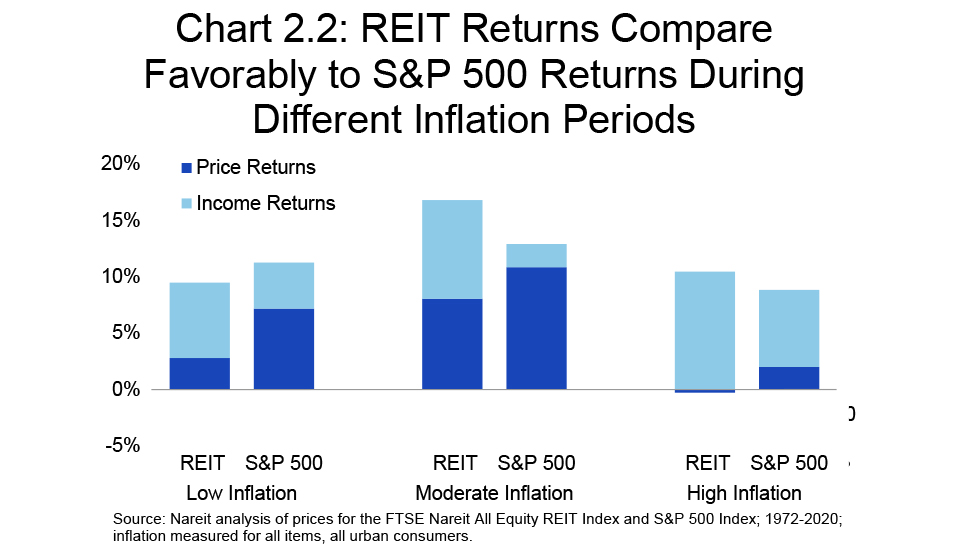

2021 Midyear Outlook For Reits And Commercial Real Estate A Robust Recovery Ahead Nareit

Fifth Virus Wave Fears Deter South African Insurer From Dividend Bnn Bloomberg

It 39 S All About The Digital Experience For The World 39 S Largest Brick And Mortar Retailer Finance Stock Market Investing

South Africa Reits Investing Offshore International Tax Review

Sa Reits Tax Benefits For Investors Sa Reit

Santa Comes Early For Reit Investors Seeking Alpha

South Africa Tax Consequences For Reits Kpmg United States

2021 Midyear Outlook For Reits And Commercial Real Estate A Robust Recovery Ahead Nareit

2021 Midyear Outlook For Reits And Commercial Real Estate A Robust Recovery Ahead Nareit

/REITS-97da07bc319a447a91c2a8c274c28712.jpeg)